This is the current affairs of 01 & 02 February 2026. Here are questions and answers of daily current affairs for better preparation of competitive exams for government jobs.

1. In the Union Budget 2026–27, what amount of income and expenditure has the Central Government targeted?

a. ₹48.21 lakh crore

b. ₹50.65 lakh crore

c. ₹53.47 lakh crore

d. ₹61.65 lakh crore

Answer: c. ₹53.47 lakh crore (₹5,347,315 crore)

– Finance Minister Nirmala Sitharaman presented the Union Budget for the financial year 2026–27 in Parliament on 1 February 2026.

– Nirmala Sitharaman presented the Budget for the 9th consecutive time.

– This was the country’s 7th paperless (digital) Budget.

Target for Income in the Budget: ₹53.47 lakh crore

– Revenue Receipts: ₹35.33 lakh crore

– Capital Receipts: ₹18.14 lakh crore (including borrowings and loans of ₹16.96 lakh crore)

Note: In the Budget for the previous financial year 2025–26, estimated income was fixed at ₹50.65 lakh crore. However, the revised estimate stood at ₹49.64 lakh crore.

——-

Revenue Receipts – Income received by the government through taxes.

Capital Receipts – Money received through loans or income generated from existing assets; no tax is levied on this.

——-

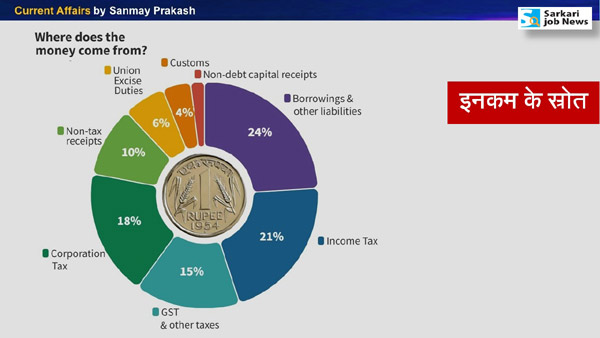

Sources of Income

– 24%: Borrowings and Other Liabilities [₹16.96 lakh crore]

– 21%: Income Tax

– 18%: Corporation Tax

– 15%: GST

– 10%: Non-Tax Revenue

– 6%: Union Excise Duty

– 4%: Customs Duty

– 2%: Non-Debt Capital Receipts

Target for Expenditure in the Budget: ₹53.47 lakh crore

– Revenue Expenditure: ₹41.25 lakh crore (including interest payments of ₹14.04 lakh crore)

– Capital Expenditure: ₹12.21 lakh crore

Note: In the Budget for FY 2025–26, estimated expenditure was ₹50.65 lakh crore, but the revised estimate was ₹49.64 lakh crore.

——

– Revenue Expenditure – Spending on salaries and maintenance of infrastructure.

– Capital Expenditure – Spending that leads to infrastructure development, such as building roads and bridges, or purchasing fighter jets.

——-

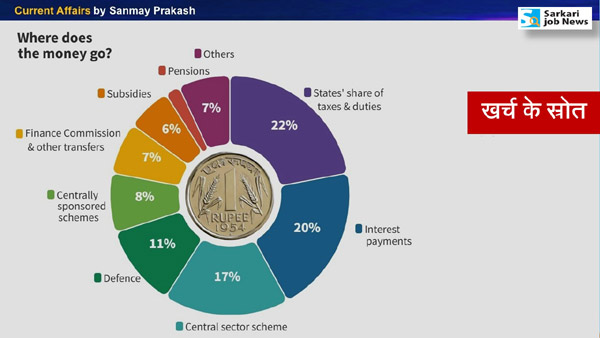

Sources of Expenditure

– 22%: States’ share of taxes

– 20%: Interest Payment [₹14.04 lakh crore]

– 17%: Central Sector Schemes

– 11%: Defence

– 8%: Centrally Sponsored Schemes

– 7%: Finance Commission and other transfers

– 6%: Subsidies

– 2%: Civil Pensions

– 7%: Other Expenditure

Transfers to States and Union Territories

– Around ₹26.21 lakh crore has been provided as transfers to states and Union Territories.

– Of this, ₹15.26 lakh crore came from the transfer of states’ share in taxes.

– Another ₹1.29 lakh crore came from Finance Commission grants.

– The amount for scheme-related and other transfers was ₹9.65 lakh crore.

————–

2. In the Union Budget 2026–27, which of the following is the largest source of income (24%)?

a. Income Tax

b. GST

c. Borrowings and Loans

d. Corporation Tax

Answer: c. Borrowings and Loans (24% of the total budget, i.e., ₹16.96 lakh crore, will come from borrowings and other liabilities)

————–

3. In the Union Budget 2026–27, after the states’ share of taxes, which head accounts for the largest expenditure—20% or ₹14.04 lakh crore?

a. Interest

b. Transport

c. Defence

d. Education

Answer: a. Interest

– The Central Government will spend the largest amount on interest payments on loans.

– A provision of ₹14.04 lakh crore has been made.

– This constitutes 20% of the total budget.

– In FY 2025–26, ₹12.76 lakh crore was allocated for interest payments. The figure has increased significantly in the new financial year due to continuous borrowing.

Target to bring total debt to 50% of GDP

– The government has set a target to bring total debt to 50% (±1) of GDP by 2030–31.

– In 2025–26, debt was 56.1%, which is estimated to decline to 55.6% in 2026–27.

– If debt reduces, the government will have to pay less interest, allowing more spending on schools, hospitals, and roads.

– Estimated GDP for 2026–27 is ₹394 lakh crore.

—————

4. How much amount (including pension) has been allocated to the Ministry of Defence in the Union Budget 2026–27?

a. ₹5.2 lakh crore

b. ₹6.8 lakh crore

c. ₹6.81 lakh crore

d. ₹7.84 lakh crore

Answer: d. ₹7.84 lakh crore (₹784,678 crore)

– This time, the Defence Ministry has received a total allocation of ₹7.84 lakh crore.

– This includes ₹1.71 lakh crore for pensions.

– The total defence budget has increased by 21% compared to the previous year.

– In FY 2025–26, the allocation was ₹6.81 lakh crore.

– Defence has received 14.68% of the total budget, the highest among all ministries (about 13.45% last year).

– Capital expenditure is ₹2.19 lakh crore, to be spent on weapons procurement and modernization of the armed forces.

Defence Budget = ₹7.84 lakh crore

– Revenue Expenditure: ₹5.53 lakh crore

– Capital Expenditure: ₹2.19 lakh crore

– Pension: ₹1.71 lakh crore

What will this amount be used for?

– The defence budget mainly has three parts: revenue, capital expenditure, and pension.

– Revenue expenditure includes salaries of defence staff and other expenses such as infrastructure maintenance and construction of roads and bridges.

– Capital expenditure is used to purchase weapons, ammunition, fighter aircraft, etc., and is the most crucial component for strengthening the armed forces.

– Out of the ₹2.19 lakh crore capital expenditure, ₹63,733 crore is earmarked for aircraft and aero engines, while ₹25,023 crore is allocated for the naval fleet.

– Remaining funds will be used for procurement of advanced light helicopters, aircraft, fast patrol vessels, training ships, and interceptor boats.

————–

5. How much budget has been allocated to important ministries under the Union Budget 2026–27?

Budget Allocation to Ministries

– Ministry of Finance: ₹19.72 lakh crore

– Ministry of Defence: ₹7.85 lakh crore (₹5.20 lakh crore excluding pension)

– Ministry of Road Transport and Highways: ₹3.10 lakh crore

– Ministry of Railways: ₹2.81 lakh crore

– Ministry of Home Affairs: ₹2.55 lakh crore

– Ministry of Consumer Affairs, Food and Public Distribution: ₹2.39 lakh crore

– Ministry of Rural Development: ₹1.97 lakh crore

– Ministry of Chemicals and Fertilizers: ₹1.77 lakh crore

– Ministry of Communications: ₹1.02 lakh crore

– Ministry of Agriculture and Farmers’ Welfare: ₹1.40 lakh crore

– Ministry of Education: ₹1.39 lakh crore

– Ministry of Health and Family Welfare: ₹1.40 lakh crore

– Ministry of Jal Shakti: ₹94,807 crore

– Ministry of Housing and Urban Affairs: ₹85,522 crore

– Ministry of Labour and Employment: ₹32,666 crore

– New and Renewable Energy: ₹32,914 crore

– Women and Child Development: ₹28,183 crore

– Ministry of External Affairs: ₹22,118 crore

– Department of Atomic Energy: ₹24,123 crore

– Sports and Youth Affairs: ₹4,479 crore

– Ministry of AYUSH: ₹4,408 crore

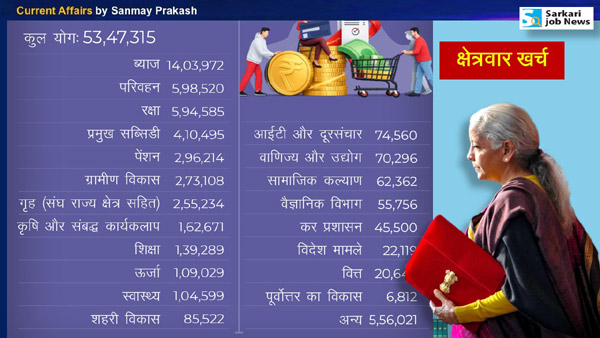

Note: If sector-wise expenditure is examined, the figures are as follows. Note that some ministries’ functions overlap, so figures may differ from ministry-wise allocations.

Sector-wise Expenditure

– Interest: ₹14.04 lakh crore

– Transport (all modes): ₹5.98 lakh crore

– Defence: ₹5.94 lakh crore

– All Pensions: ₹2.96 lakh crore

– Rural Development: ₹2.73 lakh crore

– Agriculture and Allied Activities: ₹1.62 lakh crore

– Home Affairs: ₹2.55 lakh crore

– Education: ₹1.39 lakh crore

– Health: ₹1.04 thousand crore

– IT & Telecom: ₹74,560 crore

– Energy: ₹1.09 lakh crore

– Social Welfare: ₹62,362 crore

– Commerce and Industry: ₹70,296 crore

– Urban Development: ₹85,522 crore

—————

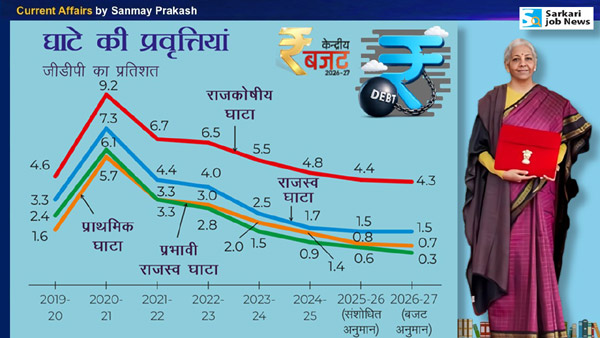

6. In the Union Budget 2026–27, what percentage of GDP has the Finance Minister set as the fiscal deficit target?

a. 5.1%

b. 4.4%

c. 4.3%

d. 3.8%

Answer: c. 4.3% (₹16.96 lakh crore)

– Estimated GDP for 2026–27 is ₹394 lakh crore.

– In FY 2025–26, the estimated fiscal deficit was 4.4%.

– The government finances this gap through borrowing.

Fiscal Deficit = Total Non-Debt Expenditure – Total Non-Debt Receipts

– Total Non-Debt Expenditure means total expenditure excluding borrowings.

– Total Non-Debt Receipts include revenue receipts and capital receipts excluding debt.

– The amount remaining after subtracting revenue receipts, recovery of loans, and loan repayments from total expenditure is called the fiscal deficit.

(In simple terms, it is the gap between net income and expenditure, which is financed through borrowing.)

Fiscal discipline maintained despite revenue shortfall

– When governments increase spending or give tax concessions, they may need to borrow more.

– Higher borrowing either crowds out private borrowing, raising interest rates, or forces money printing, leading to inflation that reduces purchasing power.

—————

7. In the Union Budget 2026–27, in how many sectors have concrete policy measures been announced to accelerate economic growth?

a. 2

b. 3

c. 5

d. 6

Answer: d. 6

(i) Boosting manufacturing in seven strategic and sunrise sectors

(ii) Reviving legacy industrial sectors

(iii) Creating “Champion MSMEs”

(iv) Massive push to infrastructure

(v) Ensuring long-term energy security and sustainability

(vi) Development of urban economic zones

– Under its first “Kartavya” (duty), the government has identified concrete policy interventions to accelerate and sustain economic growth, focused on six major areas.

The Finance Minister mentioned three “Kartavya” of the government:

– First: Accelerate and sustain economic growth by enhancing productivity and competitiveness and building resilience to volatile global dynamics.

– Second: Fulfil people’s aspirations and build their capabilities, empowering them as partners in India’s prosperity.

– Third: Ensure access to resources, facilities, and opportunities for every family, community, region, and section, in line with the vision of “Sabka Saath, Sabka Vikas.”

————–

8. In the Budget 2026–27, which neighboring country has been provided the highest grant-in-aid?

a. Afghanistan

b. Bhutan

c. Sri Lanka

d. Maldives

Answer: b. Bhutan (₹2,288 crore: ₹1,768.64 crore grant and ₹519.92 crore loan)

– A total of ₹2,288 crore has been allocated to Bhutan.

– This includes ₹1,768.64 crore as grant and ₹519.92 crore as loan.

– India provides economic assistance to more than a dozen countries.

Grant-in-aid by country

– Bhutan: ₹2,288 crore

– Nepal: ₹800 crore

– Maldives: ₹550 crore

– Mauritius: ₹550 crore

– Sri Lanka: ₹400 crore

– Myanmar: ₹300 crore

– African countries: ₹225 crore

– Afghanistan: ₹150 crore

– Latin American countries: ₹120 crore

– Eurasian countries: ₹38 crore

– Disaster relief: ₹80 crore

– Bangladesh: ₹60 crore

– Mongolia: ₹25 crore

– Seychelles: ₹19 crore

– Other developing countries: ₹80 crore

– Cultural and heritage projects: ₹20 crore

– International training/programmes: ₹1,292 crore

– Chabahar Port: ₹0

—————

9. On 1 February 2026, for which consecutive time did Finance Minister Nirmala Sitharaman present the Budget?

a. 5th time

b. 8th time

c. 9th time

d. 10th time

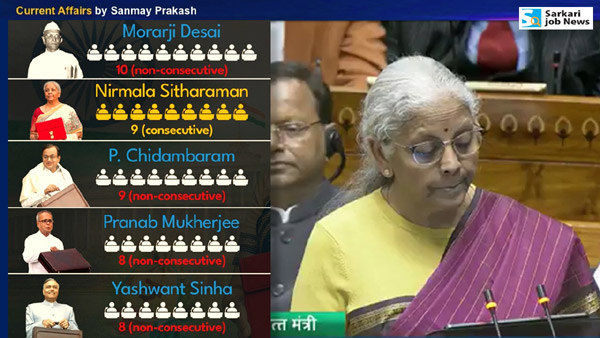

Answer: c. 9th time

– Mrs. Sitharaman delivered her ninth consecutive Budget speech in Parliament.

– This is the first time in independent India that one person has presented the Budget consecutively so many times.

– Morarji Desai presented the Budget the maximum number of times (10), though not consecutively.

Leaders who presented the Budget the most times

1) Morarji Desai: 10 times (not consecutively)

2) Nirmala Sitharaman: 9 times (consecutively)

3) P. Chidambaram: 9 times (not consecutively)

4) Pranab Mukherjee: 8 times (not consecutively)

5) Yashwant Sinha: 8 times (not consecutively)

—————

10. Major Announcements in the Union Budget 2026–27

For Youth

– Content creation labs will be set up in schools and colleges to train youth in reel-making.

– With the help of the Indian Institute of Creative Technology, Mumbai, labs will be opened in 5,000 secondary schools and 500 colleges.

– 2 million youth will be trained by 2030 for animation, VFX, gaming, and comics sectors.

– Five new townships will be developed to provide students with work opportunities alongside education.

– A ₹10,000 crore fund will be created to provide loans to gaming startups, generating over one million jobs.

– 10,000 new tech fellowships in IT and Science will be launched, focusing on AI and deep-tech research.

– Four telescope infrastructure facilities will be set up to promote astrophysics and astronomy.

– A National Institute of Hospitality will be established to prepare students for direct employment in the service industry.

– A 12-week hybrid training course will be run at 20 major tourist sites to upskill 10,000 tourist guides.

– A National Destination Digital Knowledge Grid will be created to generate jobs for local researchers, historians, and content creators.

For Women

– SHE-Marts (Self-Help Entrepreneurs) will be established to promote businesswomen, featuring retail shops run by local community women.

– One girls’ hostel will be built in every district to increase participation in higher education.

– A special fund will be created to promote women in STEM (Science, Technology, Engineering, and Mathematics).

Income Tax Relief

– No changes have been made to income tax slabs and rates.

– Income up to ₹12 lakh was made tax-free in 2025.

– Standard deduction of ₹75,000 under the new tax regime has been retained.

Employment through AI

– An “Education to Employment and Enterprises” committee will be formed to assess the impact of AI and emerging technologies on jobs.

– A ₹10,000 crore fund will be created to support small entrepreneurs (SMEs).

For Farmers

– A multilingual AI tool “Bharat Vistar” will be launched to modernize agriculture.

– Special incentives will be provided for coconut production, sandalwood cultivation, and cultivation of almonds, walnuts, cashew, and cocoa in hilly areas.

– 500 reservoirs and Amrit Sarovars will be constructed for fisheries and marketing.

– A credit-linked subsidy scheme will be launched to promote startups in dairy and animal husbandry.

– Annual assistance under PM-Kisan Samman Nidhi will remain ₹6,000, benefiting 7.8 crore farmers.

Medical and Health

– Customs duty has been removed on 77 cancer drugs and medicines for 7 rare diseases.

– Three new Ayurvedic AIIMS will be established; National Mental Health Care centres will be launched in Ranchi and Tezpur.

– ₹10,000 crore announced for the “BioPharma Shakti Scheme.”

– Three new National Pharmaceutical Education and Research Institutes will be set up to train over one lakh health workers.

– Five regional medical hubs will be developed to promote medical tourism.

– Emergency and trauma centres will be set up in district hospitals to increase capacity by over 50%.

Railways

– Railways received ₹2.81 lakh crore, about 10% more than last year.

– Seven new high-speed rail corridors will be developed.

Infrastructure

– Capital expenditure of ₹2.2 lakh crore has been earmarked for infrastructure.

– 20 new waterways will be developed for freight transport.

– A new freight corridor will connect Dankuni (West Bengal) with Surat.

Green Energy

– Tax exemptions expanded for lithium-ion battery manufacturing machinery.

– Duty removed on materials used for battery energy storage systems and sodium antimonate used in solar glass manufacturing.

Minerals

– Rare earth corridors will be developed in Kerala, Tamil Nadu, Odisha, and Andhra Pradesh.

Tourism

– 10,000 guides will be trained at 20 tourist destinations under a pilot scheme.

– Eco-friendly trekking and hiking routes will be developed in Himachal Pradesh, Uttarakhand, and Jammu & Kashmir.

Education and Medical Treatment Abroad

– TCS under LRS for overseas education and medical treatment reduced from 5% to 2% for remittances above ₹10 lakh.

————–

11. According to the Union Budget 2026–27, what percentage of central taxes has been approved as the states’ share as recommended by the 16th Finance Commission?

a. 21

b. 31

c. 41

d. 50

Answer: c. 41

– The 16th Finance Commission (FY 2026–27 to FY 2030–31) recommended retaining the states’ share at 41%.

– The government has accepted this recommendation.

– Hence, states will continue to receive 41% of central taxes.

– Several states had demanded an increase to 50%, but the status quo was maintained considering fiscal discipline and long-term goals.

Note

– GST is shared 50:50 between Centre and States.

– The 41% rule applies only to central taxes (divisible pool), not to GST.